- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

MTF: Margin Trading Facility at 1% p.m. Interest rate | Buy Stocks with 4x of Buying Power

Optimise Leverage, Maximise Your Gains with Margin Trading Facility (MTF)

What is MTF (Margin Trading Facility) in Stock Market?

Margin trading Facility is a powerful investment strategy that allows investors to increase their buying power by borrowing funds from the broker. It is a type of secured lending where the borrowed funds are secured with the investments purchased. The investors can use the borrowed money to purchase more securities than they could with their own resources.

Up to 4x margin

Up to 4x margin Estimate with Margin Calculators

Estimate with Margin Calculators Hold Stocks to Up to T+275 Days

Hold Stocks to Up to T+275 Days

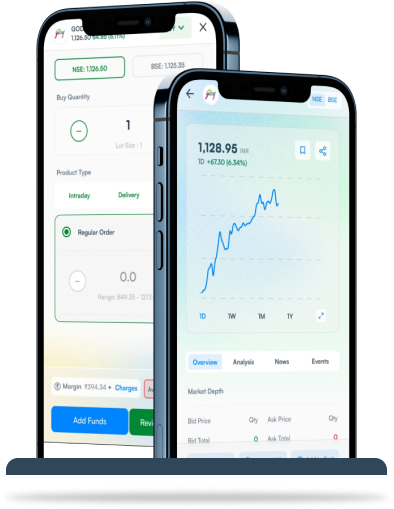

Steps to Avail Margin Trading Facility (MTF) with HDFC Sky

Robust Risk Management Tool

Flexible Collateral Options for Margin

Real-time Margin Monitoring

Open to HDFC Sky

Select Stocks to Buy

Choose MTF on Order Screen

Place MTF Order

Margin Trading Facility (MTF) Charges

Our competitive margin trading charges are designed to maximize the trading potential while minimising costs.

1% p.m. Interest on MTF Product

Delayed interest charge - 0.05%/day

Interest against collateral for derivative - 12%

Features of Margin Trading Facility (MTF) in Share Market

Increased Buying Power

Borrow funds from your broker to trade

Better Risk Management

Use strategies like stop-loss orders, diversification, and position sizing

Portfolio Diversification

Spread the investments across a wider range of securities

Leverage in Bull Markets

Increasing the investment allows investors to benefit more from market upswings

Short Selling Opportunities

Earn gains from falling markets by repurchasing securities at lower prices

Financial Growth

Become a more advanced investor

Increased Buying Power

Borrow funds from your broker to trade

Better Risk Management

Use strategies like stop-loss orders, diversification, and position sizing

Portfolio Diversification

Spread the investments across a wider range of securities

Leverage in Bull Markets

Increasing the investment allows investors to benefit more from market upswings

Short Selling Opportunities

Earn gains from falling markets by repurchasing securities at lower prices

Financial Growth

Become a more advanced investor

MTF Calculator

Check Margin with Interest Estimate

MTF Eligible Stock List

Search for any MTF-approved stock using the search bar and enter your available funds to instantly see how many shares you can buy with or without margin. You’ll also find the margin multiplier for each stock, helping you understand the leverage you can use for trading.

What is MTF in Stock Market?

Margin Trading Facility (MTF) is a financial service that allows traders and investors to purchase assets by borrowing funds from their broker. This allows the trader to purchase assets beyond their current capital. Margin trading is particularly popular with retail traders looking to leverage their funds and book higher profits by deploying MTF. The assets purchased with MTF trading serve as collateral with the broker until the loan is repaid. This collateral is a robust risk management system for the stock broker, protecting them from traders defaulting on their margin trading loans. It also helps the trader avoid overleveraging and over-margin trading. The funds provided by the broker are called a margin loan. These loans taken under a margin trading facility allow traders to purchase a high-value trade to amplify gains at a predetermined MTF interest rate on the margin loan.

How Does Margin Trading Facility (MTF) Work?

In simple terms, a Margin Trading Facility (MTF) means traders purchase assets by parking a small fraction of capital of the total trade value while borrowing the remaining funds from the broker by paying MTF interest rates. Let us assume a trader wants to purchase assets worth ₹10,00,000 but has only ₹5,00,000. The trader can utilise MTF to buy the shares by borrowing ₹5,00,000 from the broker. Assets purchased worth ₹10,00,000 by these funds remain as collateral with the broker until repayment of the margin loan. Margin trading facilities in the stock market fall under the purview of the Securities and Exchange Board of India (SEBI), which regulates margin requirements and asset eligibility for MTF. SEBI mandates brokers to have sufficient risk management procedures to safeguard brokers and investors against overtrading and overleveraging, especially with MTF in trading. Let us examine a margin trading facility in the stock market using a detailed example. For instance, a broker offers a 50% margin, and the trader wants to purchase shares worth ₹20,00,000; he needs to pay ₹10,00,000, while the broker lends the remaining ₹10,00,000. If the value of the MTF trade rises, the trader will book a profit on the entire ₹20,00,000. If the trade moves adversely, the trader will also lose the entire ₹20,00,000. This loss could very well exceed the trader’s initial investment of ₹10,00,000.

How to Buy Stocks Using Margin Trading Facility (MTF) with HDFC Sky

Let us see a step-by-step guide on how to buy shares using the margin trading facility (MTF) on the HDFC Sky trading platform:

- Open an account: Open demat account enabled for the margin trading facility.

- Check eligibility: It is recommended to check if your desired stock is eligible for MTF. Not all stocks can be traded in MTF trading. A detailed list of stocks eligible for MTF trading is available on HDFC Sky

- Select stocks: Select your desired stocks from the eligibility list. While purchasing the stock, select the MTF facility toggle before you execute the trade

- Pay the margin: Upon selecting the MTF trading option, the trader must fulfil the margin requirement by adding funds.

- Execute the trade: Once the initial margin is paid, the trader can buy the desired stocks and execute the MTF trade.

- Monitor performance: Monitor stock performance and ensure timely interest payments to avoid margin calls and forced liquidation of your MTF trade.

The margin trading facility on HDFC Sky is uncomplicated, secure and supported by advanced trading technology.

MTF on ETFs

Now invest in Exchange Traded Funds (ETFs) with the power of Margin Trading Facility (MTF). With MTF, you can buy eligible ETFs by paying only a part of the total value – The rest is funded by your broker. This helps you amplify exposure while optimizing capital usage.

ETFs already offer diversification by tracking indices like Nifty 50, gold, or sectoral baskets. Combined with MTF, they become a smart choice for investors seeking capital efficiency and flexibility.

E-Margin Trading Facility (MTF) Interest Rates and Chargers

Typically, e-margin trading interest charges are 12%-15%. The HDFC Sky MTF rate is 12% i.e. 1% per month. The MTF interest rate is critical in determining the total cost of the trade. For example, if an MTF trade generates 10% profit, but the MTF interest rate is 12%, the trader is at a net loss of 2%. It is pertinent to note that interest rates vary from broker to broker. Traders must also wonder what MTF is in stock market transaction costs; these are charges levied on all transactions made while e-margin trading and MTF trading. They are typically a nominal percentage of the trade value. Other charges are regulatory levies and GST (Goods and Service Tax). The MTF interest rate is determined by factors like the sum borrowed, internal broker policies and current market conditions. Brokers tend to amend the rate of interest mid-trade to factor in market volatility or policy changes. For instance, hikes in bank interest rates may lead to an increase in the MTF interest rate. Higher borrowed funds attract higher interest rates, as the risk also increases. Some brokers offer tiered interest rates where big sums of borrowed funds are subject to progressively higher interest charges. The asset class of the trade also significantly influences the margin trading interest; volatile or less liquid assets attract higher rates. The broker determines MTF interest rates. Some brokers charge fixed interest, and some adjust rates as per the loaned amount. The period of the MTF trading loan affects the interest rate calculation as longer durations accumulate more interest. Clients with lower risk profiles based on their credit scores are given loans at lower MTF interest rates.

Features of Margin Trading Facility (MTF)

Let us discuss the significant features of margin trading in share market on HDFC Sky.

- Borrowing Power: This is the most significant feature of the margin trading facility. MTF increases your purchasing power by leveraging your current capital, sometimes up to 4x.

- Comprehensive stock list: Access the comprehensive list of securities available for margin trading in the stock market.

- Flexible repayment options: HDFC Sky typically charges MTF interest at a fixed monthly percentage. If necessary, the margin loan can be repaid by liquidating part of the MTF trade.

- Advanced technology: HDFC Sky has advanced tools, indicators, and charts ideal for successful MTF trades.

- Regulatory compliance: MTF trading is secure on HDFC Sky; it adheres to all regulations prescribed by SEBI and RBI.

These features ensure a reliable and user-friendly experience for traders using HDFC Sky’s MTF facility.

Benefits of Investing in Margin Trading Facility (MTF)

Let us see what margin trading in share market benefits:

- Increased Buying Power: Margin trading allows the trader to trade more assets by leveraging existing capital, which helps to amplify profits when the asset appreciates.

- Greater Flexibility: With a margin trading account, traders can seize opportunities to earn profits with restricted capital. It provides flexibility to trade in fast-moving market trends to execute timely trades and seize

Risks of Investing in Margin Trading Facility (MTF)

Let us see what MTF is in share market risk:

- Increased Risk: Margin trading is a double-edged sword. While it amplifies profits, it magnifies losses, too. If the trade moves adversely, the loss could easily exceed the capital invested.

- Interest Costs: Interest rates erode profits and add more costs to the trade. In case of loss, the trader still has to pay interest on the margin trading facility.

- Margin Calls: If the trade moves adversely, the maintenance margin depletes and breaches the minimum requirement, triggering a margin call by the broker. The trader is mandated to deposit additional funds immediately in the MTF account or face forced asset depletion.

Why Choose HDFC Sky for Margin Trading Facility (MTF)

HDFC Sky is an ideal platform for MTF trading for the following features:

- Competitive interest rates: HDFC Sky offers competitive interest rates on margin loans for MTF trading. All charges, such as transaction costs, GST, and brokerage charges, are well defined. Traders can expect absolute transparency and no extra hidden costs while MTF trading.

- Advanced technology: HDFC Sky is powered by trading view charts, which offer a host of indicators, real-time global market movements, and price action calculated in seconds to decades for better technical and fundamental analysis. These tools are important features of margin trading.

- Risk management features: The HDFC Sky portal has inbuilt risk management features, such as placing stop-loss orders, for efficient risk management in MTF trading.

- Regulatory compliance: HDFC Bank is a globally trusted bank that powers the HDFC Sky trading platform. Its legacy of trust and strict adherence to all SEBI-prescribed guidelines add a layer of security.

- Customer support: Offers round-the-clock assistance for hassle-free trading for all MTF trading investors.

Whether exploring MTF in trading or seeking expert services, HDFC Sky’s MTF facility is ideal for meeting diverse trading needs.

Use MTF Facility on HDFC Sky

HDFC SKY is an advanced trading platform. It provides a one-stop solution for all trading resources, such as a trading account and demat account, real-time access to global market movements, price actions, and detailed fundamental and technical analysis, which are crucial for achieving success in margin trading. HDFC Sky offers margin trading leverage, called the “Buy Stocks Pay Later” (BSPL) option. Explore MTF on HDFC Sky today.

Know More About Margin Trading Facility (MTF)

Margin Trading 5m

Benefits of Margin Trading with HDFC Sky

Margin Trading 11m

Calculating Interest on Margin Loans: Know about Factors Influence Margin Loan Interest Rates

Margin Trading 9m

Technology and Tools for Effective Margin Trading: Role of Technology in Successful Margin Trading

Margin Trading 9m

Pros and Cons of Margin Trading: How to Avoid Margin Account Risks?

Margin Trading 9m

Margin Trading in Different Market Segments

FAQ's on Margin Trading Facility (MTF) in Stock Market

How does margin trading differ from regular trading?

Margin trading involves borrowing funds from a broker to purchase securities, allowing investors to take larger positions than they could with their own capital alone. Unlike regular trading, where you use only your own money, margin trading lets you leverage your investment by using borrowed funds.

This can amplify both potential gains and losses. In a margin account, you put up a percentage of the purchase price (the margin), and your broker lends you the rest. The securities in your account serve as collateral for the loan. Margin trading offers greater flexibility and potential returns, but it also comes with increased risk and complexity.

What are the key requirements to start margin trading?

To begin margin trading, investors need to meet several key requirements. Firstly, they must open a margin account, which involves filling out an application and providing the necessary documentation for identity verification.

The initial margin requirement mandates a certain percentage of the total trade value, usually around 40%, to be deposited in the account. However, this percentage depends on the broker. Additionally, investors must maintain a maintenance margin, typically set by the broker.

Can I use margin trading for any type of security?

While margin trading is available for many securities, it’s not universally applicable. Stocks listed on major exchanges are typically open to purchase using margin trading, but the exact list can vary by broker.

Many ETFs are also eligible for margin trading. However, penny stocks, over-the-counter (OTC) stocks, and newly issued IPOs often have higher margin requirements or may not be available for margin trading at all due to their higher volatility and risk. Options trading on margin is possible but subject to specific rules and higher requirements. Bonds, especially government and high-grade corporate bonds, can usually be purchased with margin trading.

What are the main risks associated with margin trading?

Margin trading carries several significant risks. The primary risk is amplified losses due to leverage. While margin can magnify gains, it can equally magnify losses, potentially exceeding your initial investment. Market volatility poses another risk, as rapid price movements can trigger margin calls or force liquidations. Interest charges on margin loans can erode profits or deepen losses, especially in sideways or declining markets.

There’s also the risk of changes in margin requirements, which could force you to add funds or liquidate positions unexpectedly. Regulatory risks exist too, as authorities may impose restrictions on margin trading during market turmoil. Lastly, there’s the psychological risk of overtrading or taking on excessive risk due to the increased buying power margin.

How do margin calls work, and how can I avoid them?

A margin call occurs when the equity in a margin account falls below the broker’s required maintenance margin. The broker then demands that the investor deposit additional funds or sell some securities to bring the account back to the required level.

For example, if the maintenance margin is 25% and the value of the securities drops such that the equity falls below this percentage, the broker will issue a margin call. To avoid margin calls, investors should regularly monitor their margin account and maintain a buffer above the maintenance margin to account for market fluctuations. Diversifying the portfolio can also help mitigate risk, as it reduces exposure to any single security’s price movements.

Additionally, setting stop-loss orders can automatically sell securities at predetermined prices to limit losses.

What happens if I can't meet a margin call?

When a margin call is issued, you must promptly deposit additional funds or securities into your account to meet the maintenance margin. If you can’t meet the margin call, your broker has the right to sell securities in your account without your consent to bring the account back into compliance.

This forced liquidation can occur at unfavorable prices, potentially leading to significant losses. In some cases, brokers may also charge fees for margin calls or restrict your trading privileges. It’s crucial to monitor your margin account closely and maintain adequate equity to avoid margin calls.

How do I calculate my potential returns with margin trading?

Calculating potential returns with margin trading involves considering both the borrowed funds and the interest costs associated with them.

For example, if an investor uses ₹10,000 of their own money and borrows ₹10,000 from the broker to purchase ₹20,000 worth of stock, and the stock’s value increases by 20%, the new value would be ₹24,000. The profit in this case would be ₹4,000. However, the cost of borrowing, including interest, needs to be deducted to calculate the net return.

If the interest rate is 10% annually and the position is held for one year, the interest cost on the ₹10,000 loan would be ₹1,000. Therefore, the net profit would be ₹4,000 – ₹1,000 = ₹3,000. It’s essential to factor in all costs, including interest and any brokerage fees, to accurately determine the net return on investment.

How does margin trading affect my tax situation?

Margin trading can have several implications for your tax situation. Interest paid on margin loans may be tax-deductible as investment interest expense, but only to the extent of your net investment income.

This can potentially reduce your taxable income. However, the rules around this deduction can be complex, especially with recent tax law changes. Margin trading can also impact how your capital gains and losses are calculated. If you use margin to short-sell stocks, the rules become even more intricate. Additionally, frequent trading facilitated by margin accounts might affect whether your activities are considered trading or investing for tax purposes.

What is the difference between buying on margin and short selling?

Buying on margin and short selling are two different trading strategies that involve borrowing from a broker but serve distinct purposes. Buying on margin involves borrowing funds to purchase more securities than one could with their own capital, aiming to profit from an increase in the securities’ value.

For example, an investor with ₹10,000 can borrow an additional ₹10,000 to buy ₹20,000 worth of stock, hoping that the stock price will rise and yield higher returns. In contrast, short selling involves borrowing securities themselves, selling them at the current market price, and then buying them back later at a lower price.

The goal is to profit from a decline in the securities’ value. For instance, if an investor believes a stock priced at ₹100 will drop, they can borrow and sell the stock at ₹100, and if the price falls to ₹80, they buy it back at the lower price and return it to the broker, pocketing the difference.

Can I use margin for long-term investing, or is it better suited for short-term trading?

While margin is often associated with short-term trading, it can be used for long-term investing, albeit with careful consideration. Long-term margin investing can potentially enhance returns through leveraged exposure to appreciating assets. It can also provide liquidity without necessitating the sale of existing positions.

However, the risks of long-term margin use are significant. Interest charges can accumulate substantially over time, eroding returns. Extended exposure to leverage increases the risk of severe losses during market downturns. Long-term investors using margin must be prepared for potential margin calls and have strategies to meet them without disrupting their investment plans.

Generally, margin is better suited for shorter-term strategies or tactical adjustments in a long-term portfolio, rather than as a core long-term investing strategy.