- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is Transfer of Shares?

- Documents Required for Transfer

- How to Transfer Shares from One Demat Account to Another?

- Charges While Transferring Shares from One Demat Account to Another

- Participants in the Transfer of Shares

- Time Required for Transfer of Shares

- What are The Tax Implications of Transferring Shares?

- Common Mistakes to Avoid

- Things to Consider When Transferring Shares

- Conclusion

- FAQs on How to Transfer Shares from One Demat Account to Another?

- What is Transfer of Shares?

- Documents Required for Transfer

- How to Transfer Shares from One Demat Account to Another?

- Charges While Transferring Shares from One Demat Account to Another

- Participants in the Transfer of Shares

- Time Required for Transfer of Shares

- What are The Tax Implications of Transferring Shares?

- Common Mistakes to Avoid

- Things to Consider When Transferring Shares

- Conclusion

- FAQs on How to Transfer Shares from One Demat Account to Another?

How to Transfer Shares from One Demat Account to Another?

By Shishta Dutta | Updated at: Oct 23, 2025 04:50 PM IST

Transferring shares from one Demat account to another is a straightforward process that allows investors to consolidate or shift their holdings. This can be done either online through a depository participant (DP) or offline via a Delivery Instruction Slip (DIS) depending on the type of transfer whether it’s within the same depository or across different ones.

What is Transfer of Shares?

Transfer of shares refers to the process of moving ownership of shares from one individual or entity to another. It usually occurs when an investor sells or gifts their shares to someone else. In the case of Demat accounts this transfer is done electronically through a depository like NSDL or CDSL either for personal portfolio restructuring or due to changes in account details.

Documents Required for Transfer

To transfer shares from one Demat account to another certain documents are necessary to authenticate the process and ensure smooth execution. These include:

- Delivery Instruction Slip (DIS) duly filled and signed

- Client Master Report (CMR) of the receiving Demat account

- PAN card copy of the account holder (in some cases)

- Transfer request form (if required by the broker)

- ID proof (if demanded for verification)

Always check with your Depository Participant (DP) for any additional requirements.

How to Transfer Shares from One Demat Account to Another?

You can transfer shares from one Demat Account to another in two ways: offline and online. Let’s understand both ways.

Offline Method to Transfer Shares from One Demat to Another

Here is a step-by-step guide to transfer shares from one Demat Account to another through offline mode:

- Step 1: To initiate a share transfer the transferor must first get a Delivery Instruction Slip (DIS) from their current stockbroker. This slip contains all the critical details necessary for completing the share transfer process. The transferor must accurately fill in the required fields, including information about the security being transferred.

- Step 2: The transferor must fill in the Beneficiary ID which is a 16-digit unique ID assigned to the investor. Accurately mentioning the Beneficiary ID ensures that the transfer is directed to the correct account.

- Step 3: The transferor must also provide each security’s International Securities Identification Number (ISIN). The ISIN helps identify the shares held in the Demat Account. The number of shares corresponding to each ISIN should also be specified.

- Step 4: The transfer could be for intra-depository between demat accounts in the same depository and inter-depository transfers which is between demat account with different depositories.

- Step 5: After correctly filling out the form, the transferor must sign and submit it to their existing broker. The stockbroker will charge a nominal fee for the transfer process, which may vary depending on the broker. The transferor also gets the acknowledgement slip from the broker.

After following these steps, the shares get transferred to the new Demat Account within 3-5 days.

Online Method to Transfer Shares from One Demat to Another

Online methods are convenient and allows to manage transfers from the comfort of your home. CDSL’s ‘Easiest’ facility or NSDL’s ‘Speed-e’ facility can transfer shares. Here are the steps involved:

- Step 1: Visit the CDSL’s “Easiest” or NSDL’s “Speed-e” facility online.

- Step 2:Fill the form with all the necessary information and submit it on the website.

- Step 3: Once the details are verified, the transferor receives login credentials, typically within 1-2 days.

- Step 4: The credentials can be used to log in to the system and initiate and complete the online transfer of shares from one Demat Account to another.

This online method streamlines the transfer process, offering investors efficiency and ease of use.

Charges While Transferring Shares from One Demat Account to Another

When transferring shares between Demat accounts, certain charges may apply depending on the type of transfer and the depository participant (DP). Here are the common charges:

- Off-market Transfer Charges: Most DPs charge a fee per ISIN or per share. This can range from ₹10 to ₹25 or a percentage of the transaction value.

- Stamp Duty: If the transfer is not between your own accounts (gift or sale), stamp duty may apply.

- Transaction Charges: NSDL or CDSL may levy additional transaction charges passed on by the DP.

- Courier/Handling Charges: Some DPs may charge for processing physical DIS slips.

Always check with your DP for exact fees before initiating the transfer.

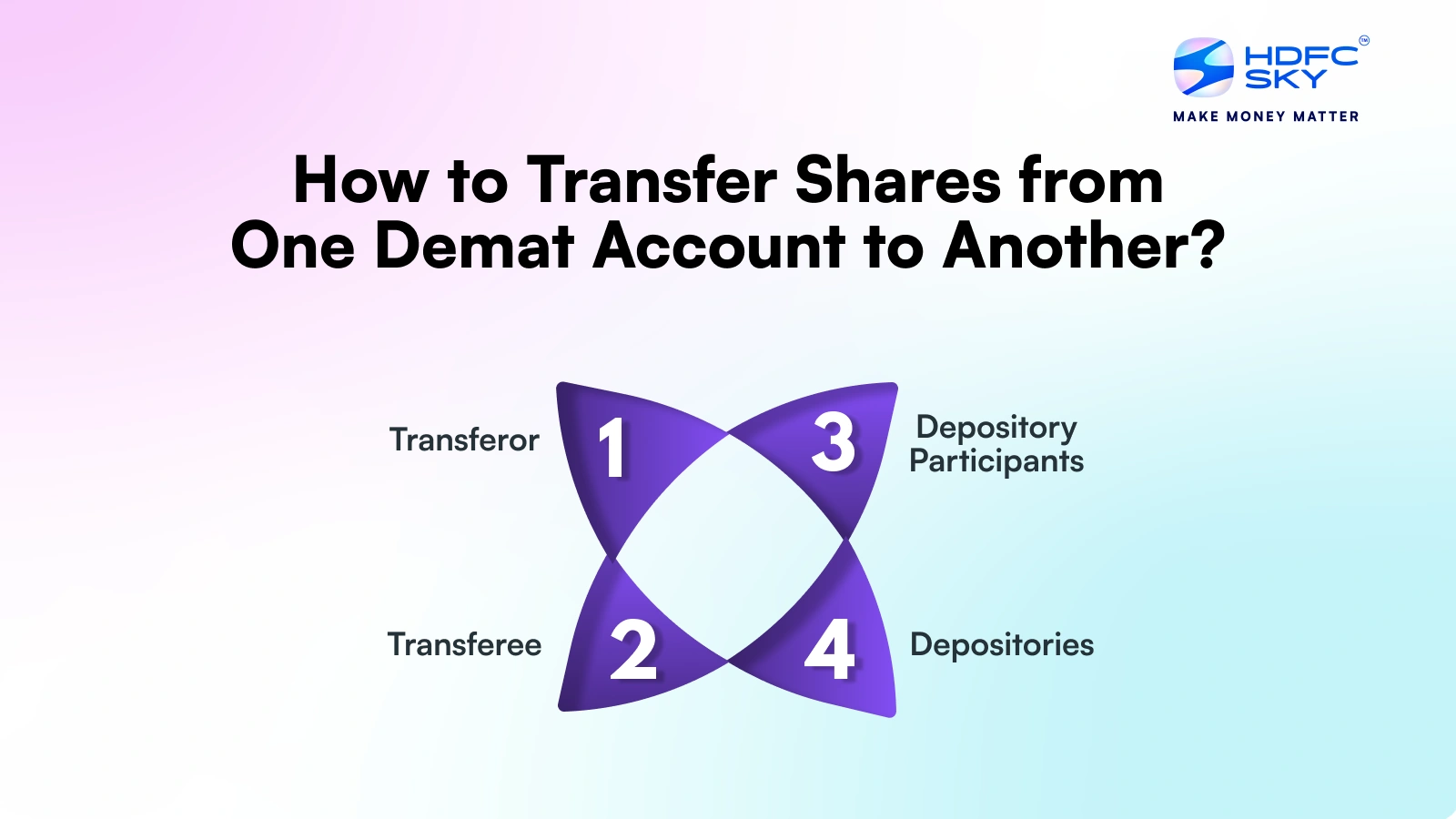

Participants in the Transfer of Shares

Several important participants are involved in transferring shares from one Demat Account to another Demat Account. Here are the key participants:

- Transferor: The current owner of the shares who initiates the transfer process.

- Transferee: The recipient of the shares will become the new owner after the transfer process.

- Depository Participants (DPs): DPs are entities that provide demat account services to investors. They are registered with depositories like NSDL or CDSL.

- Depositories: NSDL and CDSL are the depositories responsible for holding and maintaining securities in a dematerialised format.

Time Required for Transfer of Shares

Transferring shares from one Demat account to another typically takes 1 to 3 business days after the submission of the DIS (Delivery Instruction Slip).

The exact time may vary based on:

- Whether the transfer is intra-depository (within the same depository like CDSL to CDSL) or inter-depository (CDSL to NSDL or vice versa).

- The processing time of your Depository Participant (DP).

- Always track the status through your DP for confirmation.

What are The Tax Implications of Transferring Shares?

If you transfer shares from your one Demat Account to another Demat Account owned by you, then it does not have any tax implications and does not incur taxes. However if the shares are transferred into someone else’s Demat Account, then it may have tax implications.

If the shares are transferred without receiving any payment or consideration, they are considered gifts and are taxed under the provisions of the Income Tax Act 1961. Investors should seek consultations with tax experts before transferring and receiving the shares.

Common Mistakes to Avoid

Avoiding errors during share transfers ensures faster and hassle-free processing. Here are some common mistakes to watch out for:

- Incorrect or mismatched Demat account numbers

- Filling wrong ISIN codes for the shares being transferred

- Not signing the Delivery Instruction Slip (DIS) properly

- Using an outdated or pre-used DIS

- Ignoring the broker’s specific documentation or process

Double-check all details before submission to prevent rejection or delays.

Things to Consider When Transferring Shares

Before transferring shares from one Demat account to another, keep the following points in mind:

- Correct Details: Ensure the target Demat account number, ISIN and other details are accurate.

- Type of Transfer: Know if it’s an intra-depository (within same depository) or inter-depository (between CDSL and NSDL).

- Delivery Instruction Slip (DIS): Submit the properly filled DIS to your current broker.

- Transfer Charges: Be aware of any applicable charges or fees for the transfer.

- Tax Implications: Understand potential capital gains tax on off-market transfers.

- Timeframe: Transfers usually take 1-3 business days.

- Freezing Period: Shares under transfer may not be available for trading temporarily.

Conclusion

Understanding how to transfer shares from one demat account to another helps investors streamline their portfolios with minimal hassle. Transferring shares between Demat Accounts can be transferred manually or online in India. While manual transfers involve physical paperwork, online transfers are more convenient and faster. Investors need to understand the procedures, involved participants, timeframes and tax implications to ensure a smooth and efficient transfer of shares.

Elevate Your Investment Experience with HDFC Sky

Open an HDFC Sky Demat Account today and enjoy seamless management of your securities with cutting-edge technology. Secure, efficient, and user-friendly experience the future of investing with HDFC Sky.

Related Articles

FAQs on How to Transfer Shares from One Demat Account to Another?

Can you move stocks from one broker to another without selling?

Yes, you can move stocks from one broker to another without selling them. This process is known as an off-market transfer and is commonly used by investors who wish to change brokers or consolidate holdings without triggering a sale or tax event.

Can shares be transferred from one demat account to another?

Yes, you can transfer shares from one Demat Account to another online. This can be done through the online platform your depository participant (DP) provides. It is typically faster, and you must ensure all required procedures are followed, and accurate details are provided.

Can I transfer stocks from one broker to another?

Yes, you can transfer shares from one broker to another. This involves transferring shares from one Demat Account to another, which can be done manually or online.

Can I transfer shares from NSDL to CDSL?

Yes, you can transfer shares from NSDL to CDSL. This process is called an inter-depository transfer. To complete the transfer, you need to fill out the necessary forms and follow the procedures outlined by both depositories.

What is the share transfer fee from one Demat Account to another?

The share transfer fee varies depending on the stockbroker and the transfer method. Generally, online transfers have lower costs compared to offline transfers.