- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What is Sector ETF? Technology ETFs, Healthcare ETFs, Energy ETFs and Financial ETFs

By Shishta Dutta | Updated at: Sep 15, 2025 07:27 PM IST

Sector ETFs are a great way to build wealth for investors who wish to focus on specific sectors. Let us understand more about the benefits of using these ETFs to earn from growth in certain sectors of the Indian economy.

Sector ETFs are those Exchange-Trade Funds that invest specifically in sectors like defence, healthcare, energy, information technology, etc. As a retail investor, if you wish to focus your investments on a single sector that is highly profitable, then you may consider these types of ETFs.

Moreover, through these ETFs, you no longer need to choose which stocks to buy in a particular sector. You can purchase an ETF that invests in companies operating within that sector.

So, leveraging these ETFs, you can direct your investments to only those sectors that have a high growth potential.

What Sector ETF’s Appeal?

Sector ETFs appeal to investors who focus their capital on a few sectors. These are usually seasoned investors who are aware of the growth potentials of certain sectors and wish to focus their investments there. There are many reasons why these ETFs are appealing to experienced investors.

- Diversification

Instead of investing in individual stocks from a profitable sector, traders can simultaneously invest in the stocks of many companies from the same sector. This adds diversity to their portfolio while maintaining the focus on a particular sector.

- Risk Reduction

The overall portfolio risk is shared since these ETFs invest in many companies (big and small) from the same sector. This effectively reduces the risk because some stocks could compensate for the declining ones in the same sector.

- Growth Trends

Some sectors are always more profitable than others (like healthcare), while others offer higher rewards with equally high risks. Some sectors have low returns but minimum risk. Investors can choose which sectors to invest in depending on these trends.

- Future Prospects

On the other hand, some funds like energy ETFs that focus on the energy sector could boom significantly due to increasing demand for renewable energy. This type of sector investing may lead to potential gains in the future.

Types of Sector ETFs

Having understood what sector ETFs are, you can begin investing in some outlined below.

- Technology ETFs include companies that drive innovation, such as software giants in India like Infosys and TCS.

- Healthcare ETFs include companies in the healthcare, health tech, and pharmaceutical domains.

- Energy ETFs include companies that produce and distribute energy sources such as crude oil, natural gas, and even some forms of renewable energy.

- Financial ETFs include large banks, insurance companies, and other financial institutions seeking to capitalise on the market’s growth from sector ETF investments.

Factors to Consider Before Investing in Sector ETFs

However, before investing in these ETFs, you should consider the following factors of sector investing.

- You should ensure that the companies within the sector ETF you chose are aligned with your investment goals.

- You should also check the historical performance of the particular ETF and compare this to the current trends.

- You should evaluate and choose those sectors performing well even in economic downturns (i.e., those with higher risk tolerance).

Conclusion

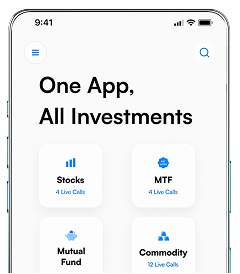

So, if you want to focus your investments towards any particular sector, then sector ETFs could be the best way. Moreover, when investing in any particular sector, you can use advanced analytical tools and dashboards provided by HDFC Sky to do your research. Online trading platforms like HDFC Sky simplify this investing journey.

Related Articles

FAQs on What is Sector ETFs

What are the major sectors represented in sector ETFs?

Sector ETFs commonly represent technology, healthcare, energy, consumer discretionary, financials, industrials, and utilities.

How do sector ETFs perform in different market conditions?

It varies by sector. Defensive sectors do well in downturns, while cyclical sectors perform well in growth periods.

What risks should I consider when investing in sector ETFs?

You should consider sector concentration risk, economic sensitivity, and potential underperformance due to sector-specific challenges.

Are Sector ETFs suitable for long-term or short-term investment?

Yes, depending on sector performance and your investment goals, they can be suitable for both long-term growth and short-term tactical plays.