- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

What is Nifty BeES ETF & How to Invest in Nifty BeES?

By HDFC SKY | Updated at: Sep 10, 2025 05:35 PM IST

Summary

- Nifty BeES (Benchmark Exchange Traded Scheme) is India’s first ETF, introduced by Nippon India Mutual Fund, designed to replicate the Nifty 50 Index performance.

- It is traded like a stock on the NSE, offering real-time liquidity and price discovery with a lot size of 1 unit, where 1 unit ≈ 1/10th of the Nifty 50 Index.

- Expense ratio is low (~0.05%), making it a cost-efficient tool for passive investing in India’s top 50 companies.

- Minimum investment is as low as the price of 1 unit, making it ideal for retail investors.

- Offers benefits like diversification, transparency, and flexibility, without requiring demat account (for SIPs via AMC platforms).

- Units are backed by underlying securities and are stored with a custodian, ensuring physical settlement and safety.

- Taxation follows equity mutual fund norms: STCG at 15%, LTCG above ₹1 lakh at 10% without indexation.

- Suitable for long-term wealth creation and index-based investment strategies.

Nifty BeES ETF is a popular exchange-traded fund that mirrors the performance of the Nifty 50 Index. It allows investors to gain diversified exposure to India’s top 50 large-cap companies with the ease and flexibility of trading like a stock on the stock exchange. This makes Nifty BeES an efficient and cost-effective way to invest in the overall market.

What is Nifty BeES ETF?

Nifty BeES ETF is an exchange-traded fund that tracks the Nifty 50 Index representing India’s top 50 large-cap companies. Nifty BeES ETF offers investors a simple way to invest in the overall market through a single tradable security.

How Does Nifty BeES Work?

Nifty BeES (Nifty Benchmark Exchange Traded Scheme) works by tracking the Nifty 50 Index which represents the top 50 large-cap companies listed on the National Stock Exchange (NSE) of India. Nifty BeES holds the same stocks in almost the same proportion as the Nifty 50 Index. This means if a company has 5% weight in Nifty 50 Nifty BeES will hold roughly 5% of its portfolio in that company’s shares.

Example of Nifty BeES: Suppose you invest ₹10,000 in Nifty BeES ETF which tracks the Nifty 50 index. If the Nifty 50 rises by 8% over the year your investment value would also increase approximately by 8%, growing to around ₹10,800 (excluding expenses). This reflects how Nifty BeES mirrors the performance of the Nifty 50 index.

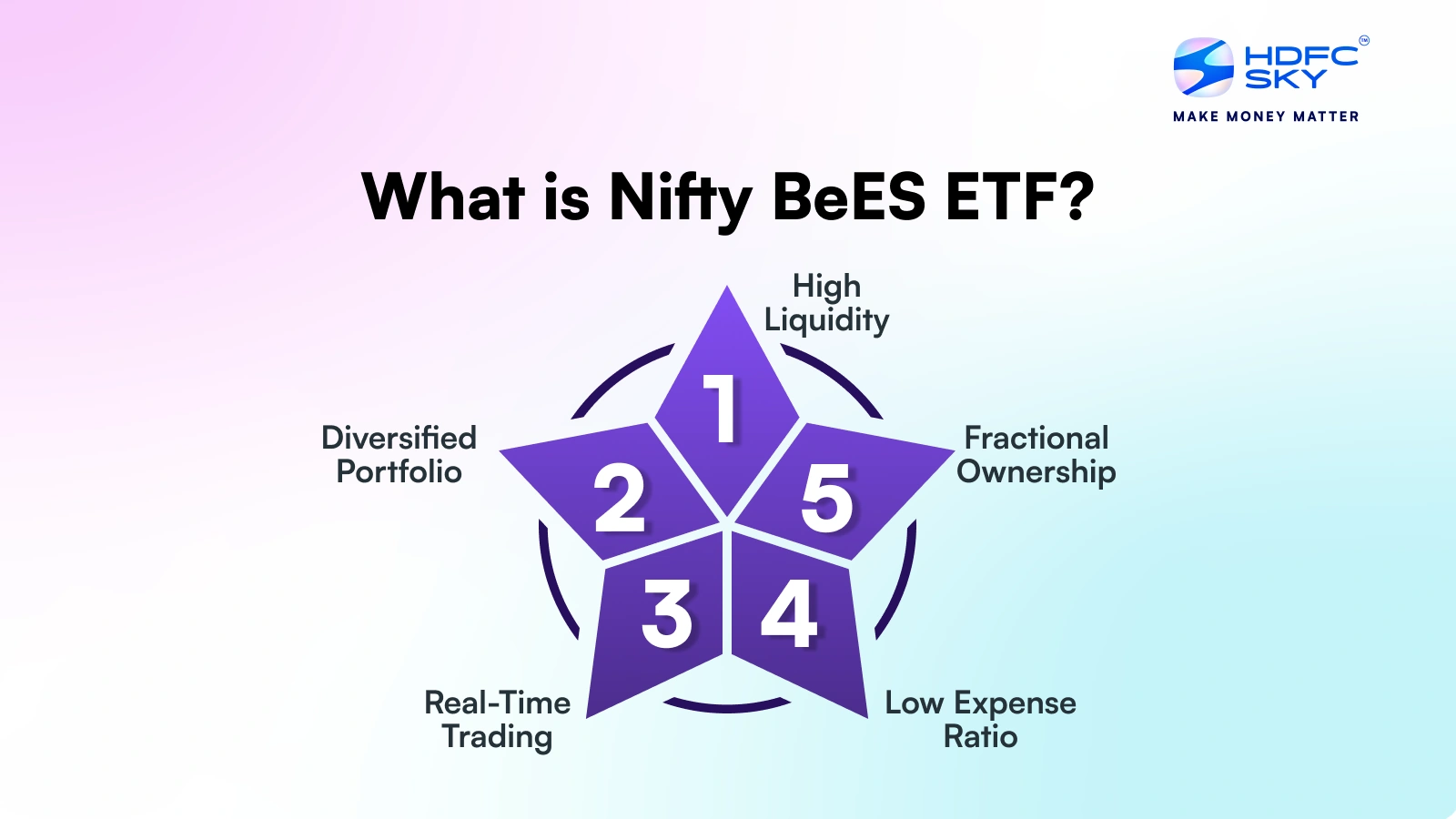

Features of Nifty BeES

Nifty BeES offers investors a cost-effective way to track the Nifty 50 index with high liquidity and transparency. Nifty BeES ETF provides diversified exposure to top Indian companies.

- Index Tracking: Passively replicates the Nifty 50 index to reflect its performance accurately.

- Diversification: Invests across 50 large-cap stocks reducing individual stock risk.

- Liquidity: Traded on stock exchanges like a regular stock allowing easy buying and selling throughout market hours.

- Low Expense Ratio: More affordable compared to actively managed funds lowering investment costs.

- Transparency: Portfolio holdings mirror the Nifty 50 index ensuring clear visibility for investors.

- Dividend Income: Investors receive dividends declared by companies in the index.

- Flexibility: No lock-in period investors can exit or enter at any time during trading hours.

- Suitable for All Investors: Ideal for both long-term investors and short-term traders seeking index exposure.

How to Invest in Nifty BeES?

Investing in Nifty BeES is simple and accessible through your stockbroker on the NSE. You just need a Demat and trading account to start buying units of this ETF.

Set Up a Trading and Demat Account

Just as you need a bank account to keep your money safe, you need a Demat account to hold your Nifty BeES units. It acts like a digital locker for your investments. You will also need a trading account, which is essentially a platform for buying and selling investments.

Identify Nifty BeES on NSE or BSE

To find Nifty BeES on the stock exchange use its unique code on your broker’s trading platform, similar to locating a specific item in a marketplace.

Place Buy Orders

To buy Nifty BeES, decide the number of units you want and place a buy order through your trading platform. You can also set a price limit to ensure you purchase at your desired price.

Monitor and Manage Your Investment

Monitor your Nifty BeES investment through your demat account just like checking your savings account for updates on your holdings. It acts like having a digital passbook that shows all your investment details.

What are the Advantages of Nifty BeES?

Nifty BeES provides low-cost diversified exposure to the top 50 Indian companies, making it an easy way to invest in the broader market. It also offers high liquidity and flexibility with intraday trading

- Ease of Fund Management: Managing Nifty BeES is as simple as operating a digital wallet. You don’t need to track 50 different companies. You just need to track a single fund which makes the process efficient and hassle-free

- Seamless Trading Experience: Trading Nifty BeES is a simple and easy process as it is available whenever the market is open. You can place orders by phone or computer at your convenience.

- Favourable Cost Structure: Nifty BeES is a cost-effective investment option because you are sharing the expenses with many other investors. The annual charges (expense ratio) are much lower than many other investment options, offering better value for your money.

- Enhanced Liquidity: Need money urgently? Nifty BeES provides high liquidity allowing you to sell your units almost instantly during trading hours when you need funds.

- Commitment to Transparency: With Nifty BeES you always know what you own and it acts like a glass jar where you can see all your investments clearly. The fund’s holdings are published daily.

What are The Limitations of Nifty BeES?

Nifty BeES has limitations like limited flexibility as it only tracks the Nifty 50 index and is subject to overall market risks. It may not suit investors seeking active management or exposure to smaller stocks.

- Passive Tracking: Nifty BeES follows the Nifty 50 index passively so it cannot outperform the market or adapt to changing conditions.

- Market Risk: It is exposed to the overall market risk, meaning if the Nifty 50 falls the ETF value will also decline.

- Limited Diversification: Since it tracks only large-cap stocks, it lacks exposure to mid and small-cap companies.

- No Active Management: Investors miss out on potential benefits of active stock selection and portfolio management.

- Liquidity Issues: Although generally liquid, on certain days, trading volumes might be lower compared to individual stocks or actively managed funds.

Tax Implications of Investing in NiftyBeES

Nifty BeES taxation is similar to equity investments in India. Let’s learn more about tax on Nifty BeES:

- Short-Term Capital Gains (STCG): If you sell Nifty BeES units within a year, the gains are taxed at 20%.

- Long-Term Capital Gains (LTCG): For holdings exceeding one year, the gains are taxed at 12.5% (without indexation benefits) on amounts exceeding ₹1.25 lakh annually.

Conclusion

For Indian investors seeking a low-cost, transparent, and diversified entry into the stock market, Nifty BeES is an excellent choice. While its returns align with the market, its simplicity, liquidity and tax efficiency make it a versatile tool for both beginners and seasoned investors.

Related Articles

FAQs on What is Nifty BeES?

How can I invest in Nifty BeES?

You can invest in Nifty BeES by buying its units through a stockbroker on the NSE, just like trading shares. Ensure you have a Demat and trading account to start investing.

How Is Nifty BeES Different from Nifty 50?

Nifty 50 is a stock market index representing the top 50 companies listed on the NSE, while Nifty BeES is an ETF that tracks the Nifty 50 index, allowing investors to invest directly in the index’s performance. Essentially, Nifty 50 is a benchmark, and Nifty BeES is a tradable fund based on that benchmark.

What is the locking period of Nifty BeES?

Nifty BeES does not have a locking period. Investors can buy or sell units anytime during trading hours, making it a highly liquid and flexible investment option for both traders and long-term investors.

What is the value of every unit of Nifty BeES?

The value of each Nifty BeES unit is 1/100th of the Nifty 50 Index. This allows investors to gain exposure to India’s top 50 companies at an affordable cost, making it accessible to both small and large investors.

What are the transaction charges for buying and selling Nifty BeES?

Transaction charges for Nifty BeES include brokerage fees, securities transaction taxes (STT), GST, and Demat account charges. These costs are relatively low, making Nifty BeES a cost-effective investment option compared to actively managed funds.

How does the liquidity of Nifty BeES impact trading during market hours?

Nifty BeES is highly liquid, allowing investors to buy or sell units throughout trading hours at real-time market prices. This liquidity ensures minimal price impact and tighter bid-ask spreads, making it an efficient choice for active traders.

What is the expected Nifty BeES return over the long term?

Over the long term, Nifty BeES returns align with the performance of the Nifty 50 Index. Historically, the index has provided steady growth, reflecting the performance of India’s top 50 companies and the broader economy.

How does Nifty BeES compare to actively managed mutual funds?

Nifty BeES is passively managed, mirroring the Nifty 50 Index, while actively managed mutual funds rely on fund managers to outperform benchmarks. Nifty BeES offers lower expense ratios and fewer risks of human error, but its returns align with the index, unlike actively managed funds that aim for higher returns.

How does the Nifty BeES expense ratio affect its performance?

The low expense ratio of Nifty BeES enhances its performance by minimising management fees. This ensures that a larger portion of the returns remains with investors, making it more cost-efficient than actively managed funds with higher expense ratios.